$2 billion spent on affordable housing since 2020, and every metric (homelessness, affordability, or homeownership rates) about housing is worse than before.

Government buries it’s head in the sand.

Oregon released its “2024 State of the State’s Housing” report late last week. The title is as uninspired as the report itself. Who the fuck came up with this name? Why isn’t it 2024 Oregon Housing Report? Dingbats. This document is a frustrating read, full of half-truth dogma, lacking any solutions, and it explains at least 4 times how to identify a cost-burden renter, I get an overall impression it wasn’t even spell-checked before publishing – I assume it was rushed to hit a deadline. Little things like this are consistent reminders that everyone you’re dealing with in Salem is worthless.

Here are the big-picture highlights:

More than half of all renters in Oregon and a third of homeowners experience a housing cost burden, meaning that they spend more than 30% of their income on housing costs.

Home prices have far outpaced wage gains over the past decade in the for-sale market

[In 2013] approximately 53% of Oregonians had a household income that qualified them to purchase the average home. Since then, wage growth has lagged, and only 29% of households could afford a typical home in 2023. This decrease is primarily because, for every dollar Oregonians earned in wage increases between 2013 and 2022, the median sales price of a home increased by $7.10, further distancing homeownership from reach.

Employers may struggle to find employees, particularly since 14 of the top 20 fastest-growing occupations have average wages insufficient to afford a one-bedroom apartment in Oregon

…the state must add about 500,000 housing units in the next two decades. … The state is approximately 128,000 affordable housing units short right now.

It’s all around bleak – but substantially worse in my mind is that the dumb fucking nincompoops dared to suggest the underlying problem is the “shortage of affordable housing.”

The reality is that this is yet another crisis solely created by our government idiots—the cure is to reduce government involvement in these things. The problems are the government’s quest to construct “affordable housing,” along with restrictions on buildable land, zoning laws, and nonresponsive permitting.

What’s wrong with the existing plan? How do we achieve affordable housing?

Understand that government can not “build affordable housing” – that’s not the way it works – if you’re still convinced it’s possible, then unfuck yourself and look around at our housing market, read the analysis, and talk to an economist. Does anyone have any evidence to point to suggest it’s working well? Government subsidized “affordable housing” is merely a scam that drives up housing costs for everyone – it’s why we’ve arrived at this situation. The people in power who have royally fucked everything up for the last decade are not in a position to solve it: they don’t have the ideas or talent to solve it.

For those who are unaware of how the housing marketplace works in a macroeconomic sense, it’s pretty straightforward: it’s essentially “hand-me-down” economics. New homes get built with a premium price tag and wealthy people who can afford the high price of a new home move in. Now there’s a wealthy person’s nice home that’s empty and a middle-class person moves in. Now a middle-class home is empty and an up-and-coming working-class person moves in. Now a working-class home is empty and it’s probably going to be turned into a rental, or a lower-income person buys it. The homes at the lowest end represent the “affordable” market – it’s usually the older homes, the less desirable homes, the types of homes people want to move out of, the “starter homes.” Eventually, the lowest end of the market becomes a blighted neighborhood - when land value prices get low enough a new cycle begins with an entrepreneur or government bureaucrat starting an urban renewal project.

New buyers leave behind homes that others can afford, creating a chain reaction.

This natural flow creates affordability at the lower end of the market.

This very simple system has generated the entire actual wealth of American workers – likely any inheritance you’ll ever see is thanks to home ownership equity, the literal embodiment of your family’s “estate.” This is precisely why homeownership is a critical metric for our society – the sovereign wealth of America is tied up in a 85 million home mortgages.

As paradoxical as it sounds, the way you “create” affordable housing is through the construction of middle-class and upper-class homes – this creates velocity in the housing market, especially by convincing middle-class and upper-class people to move out of their existing homes so that people with less economic power can buy their older home.

Of course, Oregon and Portland broke this system, and now it’s just shattered to pieces. Here’s the big picture of what went wrong:

Affordable Housing Schemes - The government’s theory of constructing “affordable housing” is a terrible idea for many reasons. First because it misallocates resources (such as the home builder’s time and resources) that would otherwise go into constructing middle-class homes - now it goes into these government projects, which raises the price of middle-class homes and raises the price of the newly constructed subsidized “affordable” home. Every dollar invested into “affordable housing” is increasing the cost of housing.

Density Targets - Urban liberals convinced themselves that we needed to prevent “sprawl” for environmental reasons, traffic reasons, for urban planning reasons. Restricting buildable land led to higher prices (exactly as a bubble would do), boosted by hapless fools in government cheering on the ballooning prices. We economically displaced a lot of middle-class workers out of the central metro area because housing prices rose too quickly (so they bought homes in places like Salem, Corvallis, etc.), and those workers then needed to commute to the central city to get high salaries. Because the real affordable “hand-me-down homes” disappeared we now have a shitload of homeless people. The underlying idea of Density Targets entirely backfired to cause sprawl across the State, it’s the reason for the traffic jams, it’s destroyed urban planning and made the whole city unaffordable. And this obliterated downtown - no one wants to use the amenities of downtown Portland because it’s overrun with tweakers who can’t even afford a flop house – besides, why would you pay a premium to shop downtown and use all of these urban luxuries when you can barely afford your housing costs?

Higher costs fuels more speculation. The lowest-end homes which were affordable were bought by speculators doing “home flipping”, or other property developers for teardowns. Like we’ll take a 100-year-old home that’s normally at the bottom of the market and do a tear-down to build an “affordable home” that costs more than the other homes in the area. The marketplace for teardowns and home flipping was driven by an inability to construct new homes elsewhere in the metro area that people wanted to buy. This was land use and zoning restrictions.

In this report, is there any hint that Oregon understands that the root of all of these problems is the bankrupt ideas of urban planning eco-utopian liberal academics? Nope --- no, the document doesn’t offer any critique of the plans.

Another nail in this coffin is that Oregon and Portland have decided they know what’s best for everyone in terms of home design – but this isn’t covered anywhere in this document. There’s a substantial and important difference in deciding to live in a 2-bedroom apartment that only has 1 parking spot, versus a single-family home with a double-car garage. We know this, everyone knows this. Oregon “improved” zoning restrictions to create homes no one wants to buy: share a wall with your neighbor, no backyard, no driveway, barking dogs, in a “mixed income” community where everyone is a crab in the bucket and you enjoy high crime rates because you can’t choose your neighbors. Zero analysis was done in this document about the type of homes we’re building and how quickly one sells versus another. Yet this is an essential and critical part of why single-family home prices have skyrocketed – and here’s a newsflash for the State of Oregon: single family homes set the benchmark for condo and apartment rent.

For example, I’m looking on Zillow.com right now on 11/25/24 with prices capped at $2,500/month.

Oregon has 1,319 single-family homes available for rent, 12,911 apartments for rent - 1:10 ratio

Texas has 28,894 homes for rent, 115,256 apartments - 1:4 ratio

Idaho has 1,178 houses for rent, 3,061 apartments - 1:3 ratio

Utah has 1,208 houses for rent, 7,429 apartments – 1:6 ratio

Nevada has 2,991 houses for rent, 10,140 apartments – 1:3 ratio

When Oregon conflates “residences” and “dwellings” they’re not all equal and pretending that building “30,000 homes this year” isn’t helpful when 10,000 of them are shit apartments with thin walls and 1 parking space. Oregon’s disproportionately low number of single-family homes compared to apartments signals a severe supply issue compared to other states. I’ll provide more insights at the end of the article.

On the positive side, there’s only one silver lining in this entire report: people are moving here less. Our terrible ideas and government have caused people to move here less frequently, but oh, as we’ll see, this causes problems in the future.

How will we achieve affordability according to this report? There’s no plan – instead, there’s excuses like housing prices being “sticky.” Home sales can crash in Oregon and nothing happens to prices, this is explained in the report:

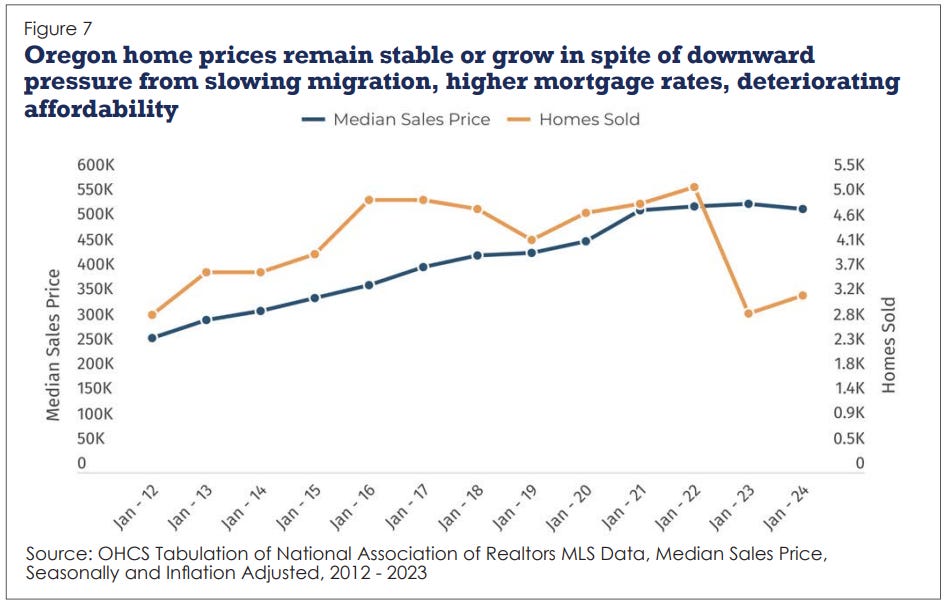

For-sale markets were sluggish in 2023, with fewer than 38,000 homes sold and only 44,000 new listings added. In fact, housing market activity slowed for two consecutive years, with 2022 showing a notable decline compared to the peak in 2021. … After the rush of activity, home sales declined by nearly 39%, and listings decreased by 33% between 2021 and 2023, reaching the lowest level in a decade. So, why didn’t home prices fall in tandem?

Oregon housing prices have steadily increased over the past several years despite fluctuations in the number of homes sold.

Before COVID-19, the number of homes sold peaked in late 2015 at 5,120 and gently trended downward over the next few years by 7.5% until early 2020. However, prices increased by 23% during this same period, or $87,132 (Figure 7). A more dramatic example of price stickiness comes from the beginning of the pandemic when the number of homes sold declined by 30% between February and May 2020, while prices decreased by just 5%. The best example of this phenomenon in Oregon occurred between 2021 and 2023 when the number of homes sold decreased by 39%, yet prices only declined by 2.3%.

Let’s be clear about this: market conditions DO NOT impact the price of a home in Oregon. Your home could be on the market for 90 days, and you could increase the price by $5k during that time. This is because it is government policies are causing the prices to increase. The hapless fuckwits who wrote this report don’t consider this at all – it’s nowhere in this report. Yet, I’m not some fringe lunatic coming up with these ideas, a few months ago I shared a 10-year retrospective on PSU Professor Dr. Gerard Mildner’s paper “Density At Any Cost” which predicted all of this nearly exactly.

Identity, politics

The paper spends a long time worrying about BIPOC people, despite decades upon decades of effort on the part of the government, outcomes haven’t improved.

In part this is because Oregon’s entire philosophy of how to help the black community is based upon lies. This report is filled with trite platitudes, suggesting that the reason black folks aren’t buying homes “is the result of exclusionary policies, wealth gaps, and institutional barriers that prevent BIPOC communities from buying a home.” This is just laughable because it was just under 10 years ago the City of Portland was begging for black residents to come forward so they could be offered preferential home financing and the program was nearly killed due to lack of interest – it took 3 years to get 4 houses sold, and now we’re up to maybe 100. The whole narrative underlying black folks history in Portland is filled with conjecture and half-truths. For example, Portland’s history of “redlining” is sourced from City Club documents in 1957 denouncing redlining and looking for ways to improve the prospects of black residents to live in the city. For those curious, that 1957 City Club document is a follow-up to this 1945 document – both are worth a read. The 1957 document explains that 2/3rds of the city favored integration – that the Portland Housing Authority was fully committed to integration as of 1950, matching the Federal policy that existed since 1949 – and this isn’t surprising given that in 1945 black people lived in 60 out of 63 of the census tracks in Portland. The whole narrative of segregated community is historically dubious. Those outside of North Portland were living “in well-kept individual family dwellings” and there was little prejudice toward a few black people living in these pockets. The 1957 document is a progress report on trying to aid black residents, it provides exact details about where discrimination did and did not exist in schools, housing, business, insurance, et al. One should probably familiarize themselves with the historical documents about what is fact or fiction before biting off on the theory that a vast conspiracy exists to deprive BIPOC people of homes. The question of how to get more black residents into homes has been studied since 1945 and has driven real policy by the City. The City Club was interested in identifying and removing all types of exclusionary policies.

Oh, and any policies that discriminated against black folks were equally applied to Japanese, Chinese, and Filipino people according to these documents – every form of institutional racism one can imagine was targeted at Asian people – but it would be fundamentally wrong for Oregon’s policy analysts to ask why Asians own more homes at a higher rate than anyone else, to ask what cultural attributes of theirs we might want to mimic or study.

With all of this effort and attention to “improving” the lives of black residents, millions upon millions spent on this cause, and somehow the rate of black homeownership declined between 2013 and 2022.

If the authors of this report are keen to help black folks, they should probably define the specific “exclusionary policies … and institutional barriers” hampering them – because we’ve been trying to pin down those damn slippery things since 1945. Maybe the folks at PBOT shouldn’t have redesigned the black community’s roadways and removed their parking spots to accommodate white bike riders? Who knows? In either case, while this report is clearly concerned about helping black folks, they got no solutions and they didn’t name any specific causes or problems attributed to this decline.

Missing from all of this race analysis is “I” in BIPOC, the Indigenous peoples. That’s probably because they’re doing pretty well, all things considered. The rate of homeownership from 2013 until 2022 is marginally better than Hispanic/Latino people, though it didn’t change much. Native Hawaiians and Pacific Islanders get their special treatment in this document and they’re doing pretty terrible all around.

The report also makes some notes about gender and sexuality equality, with perhaps the most interesting being “Women who have never been married are about 6% less likely to own their homes compared to men” which is certainly a fascinating statistic. And:

Data on the LGBTQIA+ community is severely lacking, which poses a critical issue for Oregon, where 5.6% of the population identifies as LGBTQIA+, ranking second in the nation behind the District of Columbia at 9.8% as of 2023.

A 2023 report from the Urban Institute reveals that “the homeownership rate for LGBTQIA+ people is 20 percentage points lower than for those who identify as straight and cisgender.” Part of this gap is attributed to age differences, as straight and cisgender individuals tend to be older than LGBTQIA+ individuals. Additionally, research from the Williams Institute shows that 30% of Oregonians who identify as LGBTQIA+ are food insecure, and 24% have an income of less than $24,000. In comparison, about 14.7% of all Oregonians fall into this income bracket, indicating that LGBTQIA+ individuals are 1.63 times more likely to be part of extremely low-income groups, which may contribute to their lower homeownership rates and increased risk of housing instability and homelessness.

Interesting that Oregon seems to be attracting LGBTQIA people so much so that we’re the second gayest area in the country, that our rate of poverty is spectacularly high, and only younger people are adopting this as their identity in higher droves than older populations.

Foreshadowing the destruction of the employment sectors.

The report has some sober assessments of how this is all going to impact our future labor workforce:

It is important to recognize the significant relationship between housing and labor markets, which can have broader economic consequences for both individuals struggling with housing affordability and employers. High rent prices can deter potential new residents or force families to leave their communities, ultimately impacting economic growth. Employers may face difficulties finding employees if individuals are unable to afford even a one-bedroom apartment, let alone purchase a home.

Yet, the authors also have some ambitious horseshit statements about our lofty prosperous future ahead of us:

Over the next ten years, Oregon is projected to add more than 221,000 jobs, representing a 10.4% increase from 2.1 million positions in 2022 to 2.3 million in 2032. There will also be a significant number of replacement openings. During the same period, Oregon is forecasted to add about 152,600 people to its prime working-age population (18 to 64 years old). If the projected labor force participation rates for 2032 hold, closer to only 112,000 workers will be available to fill these new positions.

….

Labor shortages are not new to Oregon, which had just over 41,000 difficult-to-fill vacancies as of the most recent job vacancy survey released in Fall 2023. While some of these shortages can be attributed to mismatches between education and job skills, low wages and high housing costs are significant factors affecting the retention of the current labor force and the attraction of new workers. … About 48% of occupational groups have average wages meeting [a rent burden] and will account for 44% of job creation projected through 2032. Of the 20 occupations expected to see the highest number of new openings between 2022 and 2032, only 14 will be able to afford the typical one-bedroom apartment. …. Oregon businesses rely heavily on in-migration for expansion and job creation, and without these workers, future labor shortages could become a serious issue. While more people have been moving to other parts of the country in the early 2020s, addressing housing affordability in Oregon could strengthen the business community and consumer base.

Good luck with that, Oregon. With our reputation in the dumpster, our state is run by rabid anti-capitalists, and double the rate of mental illness compared to the rest of the country, the job market forecast is going to be “adjusted downward” in the coming years. It’s cute the authors wrote that fixing housing affordability to retain workers “could strengthen the business community” instead of “is critical to avoid a catastrophe”. And the jobs they’re expecting to court that can afford it here? It’s nurses, corporate managers, project managers, electricians, marketers, and carpenters. Well, at least 3 out of those 5 are going to be enormously disrupted by AI.

And then there’s a whole subsection about energy prices which seems oddly out of place. No surprise, those cheap homes that people rent don’t usually have airtight windows, any form of insulation, or great HVAC systems – so poor people spend an average of $2,300 on electric bills compared to $1,900 for non-poor people. This is true in multifamily housing as well, landlords and developers cheap out on extremely expensive (and more effective) central air systems and quality HVAC, knowing they can take those financial savings for themselves and stick it to the future tenant: you can decide how much power you want to put into that shitty window-AC unit that barely lowers the temperature of your bedroom.

Pile-on time like a p. diddy party

There’s no easy way to read this report and feel assured things are going according to plan.

A lot of people have chimed in about what a disastrous situation we’re in.

OPB wrote an article "Oregon’s first statewide housing report paints grim portrait of affordability" – yeah, it's “Grim” – they rightfully noted that Tina Kotek “has staked both her political future and her legacy on improving the state’s housing” – Roxy Mayer, a spokeswoman for the governor, said in an email that the report “describes a stark reality.”

Taxpayers Association of Oregon noted several of the outlays, cause it wasn’t cheap to fuck things up so hard:

• $258 million Portland bond (2016, Ballot Measure #26-179)

• $600 million Metro bond for affordable housing (2018, Ballot Measure #26-199)

• $1 billion Metro income tax for homeless services (2020, Ballot Measure #26-210)

•$376 million Kotek housing program (2023)

Nobody should have found this report surprising, especially the shitheads in Salem or Metro who have a job to look at the economic data. Consider Oregon Office of Economic Analysis “Oregon Households Struggling with Housing Costs” written by Josh Lehner in January 2023, analyzing data from 2021:

21 percent of renter households in the state were living in poverty. However, 44 percent of rental households spend more than 30 percent of their income on rent each month. 54 percent of renters do not have enough income left over after paying rent to afford the basics. And 63 percent of rental households have incomes below MIT’s Living Wage calculation for Oregon based on various household sizes and compositions. There are hundreds of thousands of Oregon households who struggle with high housing costs relative to their incomes.

The story here is not new ... It means we know there are hundreds of thousands of Oregon households that struggle with high housing costs relative to their incomes. There is always a great need for assistance for our neighbors, family, and friends. It means we need to see an increase in overall supply of housing production to help with broad affordability. This includes new market rate housing that meets the needs of high-income households so they are not competing with low- and middle-income households for the same units, and also more targeted investments to increase the supply of Affordable and workforce housing as that is where the current needs are greatest.

The day after he wrote that article, he published “New Housing Under Construction” which shows single-family home construction in 2005 peaked at roughly 25,000 homes, and now it was under 10,000. This chart shows precisely how we dropped in single-family home construction, and this is EXACTLY the missing homes.

If by 2014 we rebounded to our early 2000’s levels, we’d average about 5,000 more homes per year, meaning we’d have another 50,000 single-family homes today. All of that housing market velocity would have assuredly helped with the 128,000 affordable housing homes we’re missing. It’s not unreasonable to speculate that with government involvement we could have achieved 20,000 single-family homes built per year on average between 2014 and 2024 (we were doing this from 2004 until 2009).

Instead of making the smart decision to build homes that people want to buy, we gambled on urban planners demanding density targets, and now about half of the renters in Oregon can barely afford Thanksgiving, and you’re looking at one of the most bleak Christmas holidays since the Great Recession.

Happy Holidays from Fidelity

p.s. like many of my posts here this was first shared over on reddit and it started a considerable amount of conversation in the comments. While you’re welcome to comment or ask questions here on Substack you might find several interesting perspectives in Reddit’s comment section. There was a particularly insightful question from /u/JeNeSaisMerde about how much legitimacy these numbers have when people are fleeing - and I think there really needs to be more economic analysis given our uncertainty. I doubt there’s a reliable 5 year forecast. A good portion of reddit readers seem to have a rudimentary grasp on why we ultimately just need more “free market” solutions in housing with less government interference. It’s hilarious how in Salem and in Portland’s newsrooms these ideas are essentially heresy, but everyone with half a clue about the world knows the emperor is naked. All the same, there’s still plenty of useless idiots around who get triggered by any critique of the U**** G**** Bound*ry.

I saw the comments on your reddit post, and was pleasantly surprised by how in-touch-with-reality the majority of people seemed to be.

I've never been one of those cuckoo bananas people who questions election integrity, but it actually has me wondering this time around. If most of the electorate doesn't seem to be communist dipshits... how did all of the crazy people sweep the city council elections?

The leading cause of homelessness is excessive government regulation.